How Do I Get A Gifted Deposit Template Nationwide

Gifted Deposits Explained

Saving a deposit for a house is one of the biggest hurdles for first-fourth dimension buyers, so it's no surprise that gifted deposits are a common feature of buying a home. Find out what gifted deposits are, how they work and the legal and revenue enhancement implications

House prices are at such a high level that the boilerplate deposit required past get-go-fourth dimension buyers has increased significantly over the years. According to Halifax, the average deposit first-time buyers paid in 2021 was almost £59,000. For many people, saving this corporeality of coin is unachievable. Which is why so many aspiring homeowners wait for fiscal assist, in the class of gifted deposits, to assist heave their savings and get a step on the belongings ladder.

What is a gifted deposit?

A "gifted eolith" refers to coin given to a homebuyer to help them buy a property. The amount of coin gifted tin exist a contribution towards the deposit or equate to the whole deposit. However, it's non as straight-forrard as a parent just transferring the coin into a kid'due south account and saying it'southward a gift. There are a number of factors to consider which we outline below.

Why is a bigger deposit better?

A deposit of 5% is usually the minimum a mortgage lender will require. Just the bigger your deposit, the meliorate off you are considering:

- yous won't need to infringe every bit much, which means your monthly mortgage repayments will exist cheaper

- you can access a wider selection of cheaper mortgage products.

So fifty-fifty if you take saved enough for a eolith to buy your get-go home, yous tin benefit from a gifted deposit elevation-upward. For example if yous have a 25% deposit, rather than a 10% eolith, your mortgage payments will be more affordable.

How do gifted deposits work?

Gifted deposits are merely that – gifted. Unlike a loan, they are given with the understanding that the coin doesn't need to be repaid. The person gifting the coin has no rights or legal interest in the property being purchased. If parents are considering ways to help their children go on the property ladder, a gifted eolith can be the easiest way.

Mortgage Finder

Become fee gratuitous mortgage advice from our partners at Fifty&C. Use the online mortgage finder or speak to an counselor today.

Find a mortgage

Who can souvenir a deposit for a mortgage?

About mortgage lenders prefer it if the person gifting you the coin is an firsthand relative, such every bit a parent, grandparent or sibling. Yous can likewise receive a gifted deposit from a partner. Merely more than distant relatives such as aunts and uncles, or friends, may non be allowed. Other lenders' lending criteria may state information technology must be a parent who gifts the coin.

Most lenders won't have a gifted deposit if the person giving the money is the vendor – the person selling the house. It may seem similar an unlikely prospect but it could be a problem if you're ownership a business firm from your parents or some other family unit member.

How practise y'all go a mortgage with a gifted eolith?

If you're expecting a gifted deposit, it'southward a good thought to talk through your options with our mortgage brokers L&C equally they will know what dissimilar lender rules apply and tin can help y'all notice the best mortgage deal.

Y'all will also need to inform your conveyancing solicitor that yous are buying with a gifted deposit.

Do y'all take to declare gifted deposits?

Yes. You'll need to inform your mortgage lender and your solicitor that your deposit has been gifted as office of their anti-money laundering checks.

What is a gifted deposit annunciation or letter?

If you receive a gifted deposit, your lender may require whoever is gifting you the coin to sign a 'Gifted Eolith Letter'. This volition need to include:

- The name of the person receiving the gift

- The source of the funds

- The relationship between the person gifting and receiving

- The corporeality of money

- Confirmation information technology'due south a gift with no expectation of repayment

- Confirmation the person giving the souvenir won't get any stake in the property

- Show the person gifting the money is financially solvent

Bigger banks and building societies will usually take a gifted deposit declaration form that can be filled out. Just smaller lenders may request a signed and certified letter. However, if yous're unsure nearly your alphabetic character, information technology's a good thought to speak to your mortgage broker who'll be able to advise yous.

Find the best mortgage option for yous with our fee complimentary mortgage broker service L&C

Does the person gifting the coin demand to provide anything else?

The person gifting you the deposit will besides need to provide:

- Proof of funds: If the money existence gifted comes from an expected source, such every bit the sale of a home, this is easy to prove. If the money has been saved up over fourth dimension, multiple bank statements may be needed to be supplied to your solicitor to meet the anti-money laundering checks.

- Proof of ID: The family member or friend gifting the money volition need to show photo ID, such every bit their passport. Plus, they'll need to provide two proofs of accost.

Can the deposit be loaned instead of gifted?

Mortgage lenders view gifted deposits and loaned deposits as completely different things. A bank may take a loaned deposit, provided there's a signed declaration that information technology will only need to exist repaid when the property is sold. If that's not the case, they volition view the loan every bit a fiscal delivery, similar a credit card. So it will factor in the planned repayments when assessing the buyer's affordability.

How big can gifted deposits be?

At that place is no limit on how large a gifted deposit you receive can be, unless a lender stipulates this. Simply bear in heed the souvenir could be subject to inheritance tax.

What are the rules on gifted deposits and inheritance tax?

If you're lucky enough to be offered a big gifted deposit, you should consider the implications of inheritance tax. Everyone is immune to give abroad up to £3000 per yr, exempt from inheritance revenue enhancement. Any unused assart can be carried over from the previous year. So parents could gift their child £12,000 without inheritance revenue enhancement being an issue. This is provided they haven't gifted whatsoever other money to anyone in the two years previously. But if the corporeality is bigger than that or if the person giving the money doesn't have the full annual inheritance revenue enhancement assart, the money could be liable for inheritance tax.

This is because if the person gifting the coin dies within seven years of handing it over information technology would notwithstanding be classed every bit part of their manor for inheritance tax purposes. And so if their total estate, including the gift, is worth more than £325,000 so upward to 40% taxation would be due on the excess. And the corporeality of revenue enhancement due on the gift decreases as the seven years elapse.

To notice out more, read our guide How to continue on top of inheritance tax

If I become a gifted deposit, can I add my own savings to it?

Admittedly. The bigger the deposit you can raise, the more affordable your repayments will be and the greater the range of mortgages you'll usually accept access to. Every bit mentioned above, you lot may get access to better rates too, specially if you can save enough to become to a key threshold, such as a fifteen% or 20% deposit.

How tin parents protect a business firm eolith gift?

If y'all're gifting your child a deposit and they're buying a property with their partner or friend, you lot can protect the money you have gifted in the event they split with a declaration of trust, or deed of trust. This can exist drawn up by the solicitor working on the property. It will country who the money was given to – this allows you to specify that y'all gifted it to your chid and non to them and their partner. So if the couple separate up, it will make sure your child keeps ownership of the coin you gifted.

Information technology can also clarify whether the money is a souvenir or a loan. And if it's a loan, when it needs to be paid back. A deed of trust can too be used by the people buying the property to set out responsibilities for outgoings and what will happen to the belongings if they pause upward. Nonetheless, if your child goes on to ally the person they bought the habitation with this could affect the deed of trust.

Means to fund a gifted deposit

Some homeowners choose to apply equity release to permit them to unlock cash from their home for a gift. But this can exist an expensive commitment and yous should consider it carefully, taking contained financial advice. The same tin can exist said for anyone considering accessing money from their savings or pension to souvenir to a child.

Alternatives to gifted deposits

And if your parents or family unit desire to assist you but tin't afford to gift yous money, at that place are still means they can help you with your purchase. Such as:

Family Springboard Mortgages: With these mortgages, a family member or friend puts a eolith on the property on your behalf, typically 10%, into a savings account. This business relationship is linked to the mortgage y'all can then take out on the holding. Your loved one will take to agree to leave the money in the account for a set catamenia of fourth dimension. And they can earn interest on the money they've put downwards. Only, if you miss any payments, it may take longer for your loved one to get their money dorsum. And they may not go their full savings and interest dorsum. Read if information technology's right for you lot in our commencement mortgages guide

Guarantor mortgages: With guarantor mortgages, your family unit member or friend agrees to guarantee to brand the repayments on your mortgage should you autumn backside. But if you're a guarantor in that location are risks to consider; if the person you lot're the guarantor for miss repayments you may risk losing your savings or even your home.

Take out a joint mortgage: You could purchase a dwelling house with your kid and take out a joint mortgage. This would make yous equally liable for the repayment of the loan. One advantage is that your combined incomes may mean yous can beget to take out a larger loan. However, one major drawback is if y'all already own a holding, then the new home you purchase with your kid would count as a second home. This ways there would be an additional 3% stamp duty due, which could brand the holding significantly more expensive. Also, if it's your second home and you lot're still on the mortgage when the house is sold, you may exist liable for upper-case letter gains revenue enhancement. Some lenders permit you to accept on a joint mortgage, simply your proper name doesn't have to be added to the property'south title deeds. This allows yous to go around these tax issues.

With all of these options information technology'southward important to get advice earlier making any decisions.

Are gifted deposits that common?

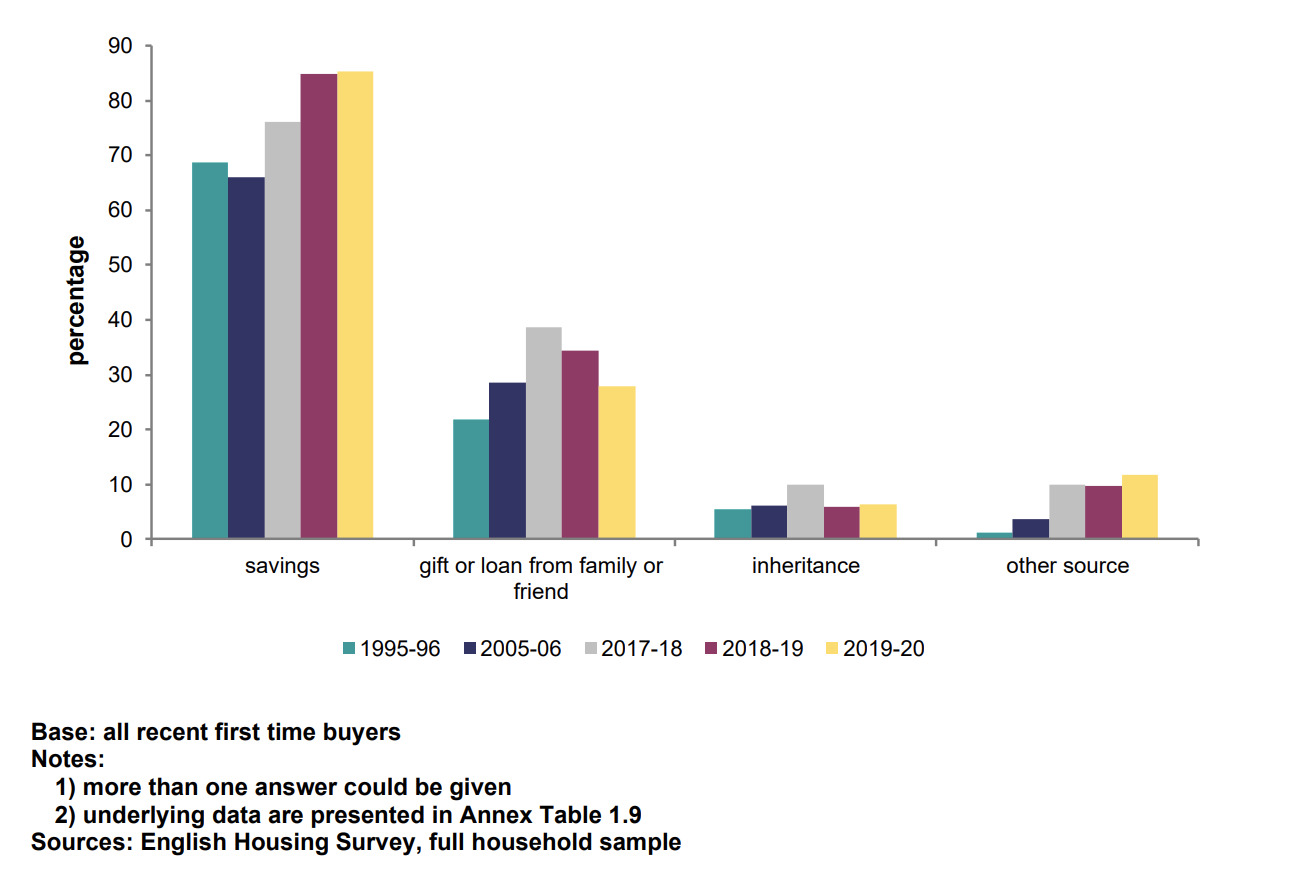

Information technology seems not everyone is lucky enough or maybe wants to accept fiscal help. According to the English language Housing Survey 2019-2020, most first time buyers (85%) funded the purchase of their start abode with savings, but 28% reported receiving help from family or friends while 6% used an inheritance as a source of deposit.

Between 2017-eighteen and 2019-20, the proportion of first time buyers using savings to buy their first home increased (from 76% to 85%), whereas the proportion receiving a gift or loan from family unit or friends decreased from 39% to 28% over the same period.

The graph beneath shows the source of deposit for contempo first fourth dimension buyers, 1995-96, 2005-06, 2017- xviii, 2018-19 and 2019-20.

Do lenders accept to allow gifted deposits?

No. Lenders can rule out gifted deposits.

During the height of the COVID-19 pandemic, when the economic climate was uncertain and lenders became very risk balky, some lenders restricted the utilise of gifted deposits. For instance, Nationwide launched a ninety% LTV mortgage, and stipulated that buyers would demand to bear witness at least 75% of their deposit came from their own savings. This capped the corporeality of money buyers could use from gifted deposits. Only Nationwide has since relaxed its rules. And gifted deposits are now widely accustomed again by lenders. However, as lenders' lending criteria is field of study to change, it's always a wise motility to speak to a mortgage broker to get the about up-to-date data.

Practice you want to buy a home with a gifted eolith? You can become fee-free advice from accolade-winning mortgage brokers L&C. They're available seven days a week and can talk you through everything you demand to know.

How Do I Get A Gifted Deposit Template Nationwide,

Source: https://hoa.org.uk/advice/guides-for-homeowners/i-am-buying/gifted-deposits/

Posted by: davidsonmushe1960.blogspot.com

0 Response to "How Do I Get A Gifted Deposit Template Nationwide"

Post a Comment